AMAS Investments Ltd offer a multitude of investment solutions and an extensive range of products that are available in the UK, plus offshore investment opportunities.

Types of investments we advise on include:

- Investment Trusts

- Unit Trusts

- OEICs

- Endowment Policies

- Investment Bonds

- ISAs

- Annuities

Risk and Reward

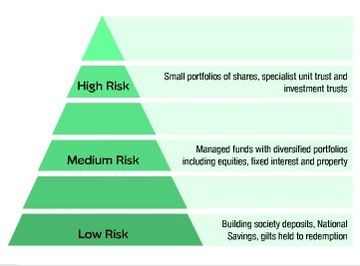

Different people have different attitudes to risk. You need to be clear about the degree of risk you are willing to accept before undertaking any kind of investment. The following is an example of a Risk/Reward profile.

Risk Profile

- These risk categories are for guidance only. Your IFA may have chosen

different ways of categorising risk. - Different people have different attitudes to risk.

- You need to be clear about the degree of risk you are willing to accept.

- This is a difficult area as everyone views risk differently.

- There is a balance between risk and potential return – generally speaking higher risk investments potentially usually mean that higher returns may be possible BUT also the risk of losing money is also increased.

- Lower risk generally means lower returns but a lower risk of losing money – nothing is ever set in stone though!

- Risk is also related to how long investment is undertaken. With Stocks and shares you should be taking a longer term view – most commentators advise that a 5 year investment time frame is wise.

- Risk can also be in terms of how you invest. Investors wishing to minimising risk would consider a broader investment spread as opposed to investment in a specialist area.

Past performance is not a reliable indicator of future results. The value of investments and the income from them can go down as well as up. The level of tax benefits and liabilities will depend on individual circumstances and may change in the future. Exchange rate fluctuations may cause the value of underlying overseas investments to go down as well as up. Some Funds investing in specialist sectors or areas carry greater risks due to the potential volatility of market sectors into which the funds invest.

You should not invest without consulting a Key Features Document and supporting literature.

Unit Trusts

Unit trusts are a popular investment vehicle today, they are 'open ended collective investments' which put the cash of many investors into one fund a 'pooled fund'. This system allows investors to invest "collectively" which has the benefits of spreading and reducing risk and keeping costs under control. Unit trusts allow you to invest in the stock market but enable you to spread your risk and benefit from expert investment management.

There are many unit trusts to choose from across a wide range of investment sectors. The managers of the trusts can buy and sell within the trust without having to pay any tax, however tax liabilities can arise on dividends and unit sales by the holder.

OEICs

What is an OEIC?

- Open-Ended Investment Companies are often referred to as the modern day and flexible equivalent of the unit trust. They combine the elements of unit trusts and Investment trusts enabling you to pool your investments along with other investors. This helps to spread the risk and enables you to take advantage of the skills of a professional managing the fund.

- OEICS are regulated by the FCA. The rules are based on specifically written company law, whereas unit trusts are based on old trust law.

- OEICS have a single price for buyers and sellers and the charges are shown separately. A unit trust has a separate buying and selling price (bid/offer spread).

- The OEIC share price directly reflects the underlying assets of the portfolio

- An Umbrella Fund structure, which means that there are different classes of share. Each sub share fund can be invested in a different area if required.

Investment Trusts

An Investment Trust is simply a company that has been set up to invest in shares of other companies. By buying shares in an investment company, the investor is in effect spreading the risk that would normally by associated with a single share investment because the value of the Investment Company's shares are directly related to the spread of investments it is making.

From a tax perspective, investing in investment trusts is treated the same as investing in shares.

ISAs

Individual Savings Accounts (ISAs) are available to all UK residents over 18 years of age, 16 years of age for the Cash ISAs. They benefit all taxpayers, as any income or capital gains received from investments held within an ISA do not have to be declared to the tax man.

ISAs can invest in cash or in stocks and shares (including unit trusts, investment trusts, Open Ended Investment Companies, some fixed interest securities, or any share quoted on a stock exchange recognised by H M Revenue and Customs.)

The overall ISA limit has increased to £11,880 for the 2014/2015 tax year. Up to £5,940 can be placed within a Cash ISA and the balance (up to £11,880) into a Stocks and Shares ISA. You can take out a Stocks & Shares ISA and a Cash ISA in the same tax year subject to the overall limit applicable to that tax year. For example if you placed £2,000 in a Cash ISA, you could then invest the balance of £9,880 in the Stocks & Shares ISA.

Investment Limits

Cash ISA's - Cash ISA's are widely available with different interest rates. It is a good idea to shop around for the best Cash ISA rates. It is important however to understand the conditions attached to those rates, for instance access may be restricted in order to achieve that particular rate.

Stocks & Shares ISA- Assuming you haven't invested in a Cash ISA in the same tax year you can invest £11,880 in the current year (2014/2015) in a Stocks & Shares ISA.

THE VALUE OF INVESTMENTS AND INCOME FROM THEM MAY GO DOWN. YOU MAY NOT GET BACK THE ORIGINAL AMOUNT INVESTED.

Government Gilts

Government backed stock, known as 'Gilts' are loans made to the Government by in effect the investors. Much of the national debt is comprised of Government Gilts, so when the Government needs to 'borrow' more, it simply issues a new Gilt.

Gilts provide income derived from interest payments and a final redemption. Inflation erodes away at the true value of the Gilts redemption, whilst interest rates will make the Gilts income appear more or less attractive. Broadly speaking when interest rates rise the value of the Gilt will fall and vice versa. Many professional investors and fund managers invest part of their portfolio in Gilts because Gilts can help them to spread risk and/or provide income.

Corporate Bonds

Corporate Bonds are similar to Gilts, and work in much the same way, however Corporate Bonds, as the name suggests, are issued by multinational companies as opposed to Governments. They do this as a cheaper form of borrowing than a bank loan and often offer better returns than Government Gilts. They have to because the risk of a corporate going bankrupt, even a multinational one, is greater than the risk of a Government being unable to repay it's debt.

Corporate Bonds are usually invested in by fund managers and other 'professionals' and as per Gilts, they usually do this to produce income and/or spread risk.

What is ESG Investing?

ESG stands for environmental, sustainable and governance.

This is an increasingly popular field of investing with the focus, not just on your investment goals, but also in incorporating your ethical principles in to making positive change.

We work on combining our tested method of finding quality investments to attain your financial aspirations which compliment your ethical aims or concerns.

It is a common misconception that if you invest in line with your ethical principles, you’ll have to sacrifice investment performance, but there is an increasing number of competitively performing ESG products on the market.

If you would like to find out more about this approach to managing your wealth, please contact us today and we will match you with an adviser catered to finding your solution.